Summary:

- Africa real estate continues to attract growing investment in residential and commercial sectors.

- Real estate in Africa is influenced by urban growth, infrastructure development, and rising middle-class populations.

- African real estate hotspots include Nairobi, Lagos, and Accra, each offering specific investment opportunities.

- Real estate in Africa market data shows steady growth in property development, rental yields, and property values.

- Investors can access insights on real estate in Nairobi and leading real estate companies in Kenya to guide decision making.

Introduction

Africa real estate is undergoing substantial transformation in 2025. Urbanization, population growth, and increased foreign investment are creating opportunities in residential, commercial, and mixed-use developments. Investors and developers are focusing on cities with high demand for housing, office spaces, and integrated business districts.

This guide presents current trends, investment hotspots, and actionable insights into real estate in Africa, offering data backed observations to help investors make informed decisions.

Africa Real Estate Market Overview

The African real estate market has expanded steadily over the past decade. Economic growth in countries such as Kenya, Nigeria, Ghana, and South Africa has led to higher demand for both residential and commercial properties.

Residential demand remains strong, particularly in rapidly growing urban areas. Cities are seeing new housing projects, including mid-range and affordable options, to meet the needs of expanding populations. Commercial real estate is evolving to accommodate businesses, technology hubs, retail centers, and mixed-use developments.

Foreign investors are increasingly entering the market due to competitive returns, urban growth, and opportunities in commercial development. Legal and regulatory frameworks differ across countries, making local expertise essential for secure property acquisition.

Population growth also impacts property demand. Sub-Saharan Africa is projected to grow by more than 400 million people by 2030, with a significant portion concentrated in urban centers. This demographic trend supports ongoing investment in residential housing, offices, and retail infrastructure, positioning Africa real estate as an attractive long-term investment sector.

Key African Cities for Investment

1. Nairobi

Nairobi is a central hub for Africa real estate investment. The city has seen consistent growth in both residential and commercial sectors. Urban expansion and infrastructure projects, such as new transport networks, business parks, and commercial districts, have increased property values.

Investors exploring real estate in Nairobi Kenya can consider emerging suburbs, which offer higher potential returns on residential developments, and commercial areas in the central business district, which attract multinational corporations and retail businesses. The rental market is also growing, providing consistent income streams for investors.

2. Lagos

Lagos has become a hotspot for commercial real estate investment. High-density residential projects, office spaces, and industrial parks are developing in response to population growth and business activity.

Property demand in Lagos is influenced by rapid urbanization and the city’s role as Nigeria’s economic center. Investors can focus on office spaces in business districts and residential developments near emerging urban centers to capitalize on rental income and capital appreciation.

3. Accra

Accra in Ghana has a growing residential and commercial property market. Urban expansion, government infrastructure projects, and foreign investment in housing projects are driving the growth of African real estate in the region.

Investors in Accra can evaluate mixed use developments combining residential and retail spaces, as well as commercial hubs that accommodate new businesses. Population growth and rising middle class demand are creating opportunities for both rental and ownership markets.

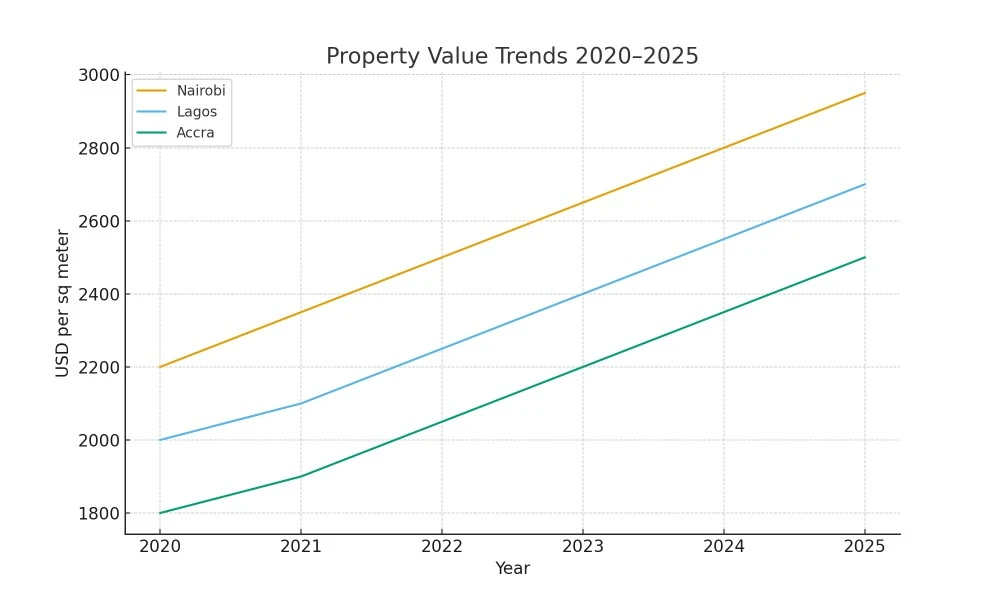

Property Value Trends Chart

Insights on Real Estate Companies in Kenya

Understanding the local market requires awareness of reputable market players. Several real estate companies in Kenya operate in residential, commercial, and mixed-use development sectors.

These companies provide property management, consultancy, and investment advisory services. Comparing their portfolios helps investors identify reliable partners and evaluate potential opportunities in African real estate.

Some companies specialize in high end residential developments, while others focus on affordable housing or commercial projects. Investors benefit from reviewing project histories, client reviews, and market experience to make informed decisions.

Trends in African Real Estate

Current trends are shaping the real estate Africa market across multiple countries:

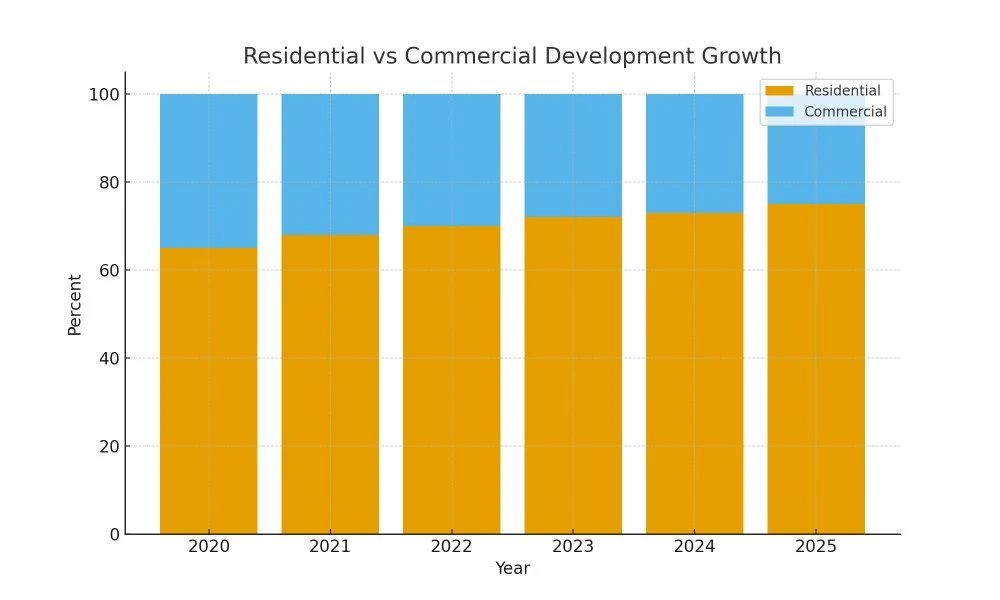

- Residential housing demand is growing, driven by urban migration and the expansion of the middle class. Developers increasingly focus on mid-range housing to match purchasing power.

- Commercial real estate is evolving with technology-driven offices, business hubs, and co-working spaces.

- Mixed-use developments that integrate living, working, and leisure spaces are gaining momentum, particularly in major cities.

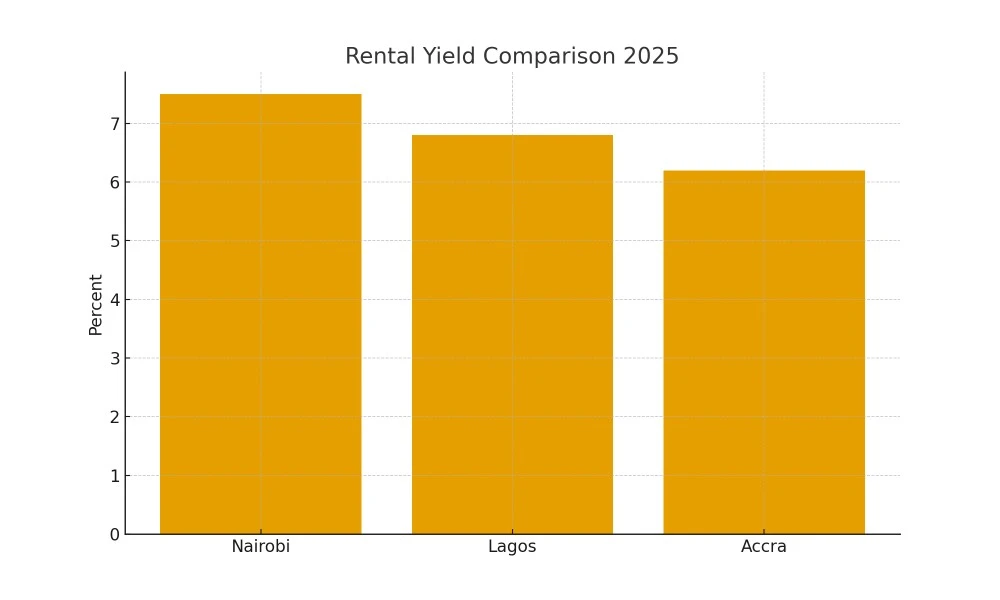

- Property values and rental yields are increasing in key urban centers. Investment data indicates that cities like Nairobi and Lagos have annual property value growth between 6–9 percent.

- Foreign investment in African real estate is rising, particularly in sectors such as commercial offices, hotels, and industrial properties.

Residential vs Commercial Growth Chart

Rental Yield Comparison Chart

Buying Property in Kenya

Acquiring property in Kenya requires careful planning. Investors should evaluate neighborhoods, assess proximity to infrastructure projects, and analyze property types before making decisions. Legal requirements, including title registration and zoning compliance, must be observed.

Exploring real estate in Kenya and consulting experienced companies helps streamline the process. Investors should consider the credibility of developers, potential rental returns, and long-term capital appreciation. Market trends, such as suburban expansion and new business districts, also influence investment decisions.

Practical tips for property investment include reviewing past sales data, consulting local experts, and understanding the regulatory environment. These steps help mitigate risks and ensure secure ownership.

Conclusion

Investors should review city-level data, analyze market trends, and study company profiles to make informed decisions. Using evidence-backed insights on Africa real estate can help identify profitable opportunities and navigate the complexities of real estate in Africa.

Monitoring real estate trends in Nairobi Kenya, engaging with leading real estate companies in Kenya, and exploring real estate investment opportunities in Kenya ensures comprehensive insight into investment options.

Get in Touch