Summary:

- National residential price growth across Kenya averaged 6.8 percent in 2024 with Nairobi and its commuter zones leading activity.

- Apartment units accounted for an estimated 64 percent of all new housing completions in urban Kenya during 2024.

- Mortgage uptake in Kenya grew by approximately 9 percent year on year despite higher interest rates.

- Rental yields in prime urban locations remained between 5.5 percent and 8.2 percent depending on asset class.

Introduction

The 2025 market data report on real estate in Kenya captures a transitional period shaped by inflation control measures, infrastructure expansion, diaspora remittance growth, and sustained urbanization. Real estate in Kenya continues to reflect strong demographic demand tied to population growth and household formation. Kenya real estate also reflects rising investor caution due to tighter credit conditions.

Urban migration remains the main demand driver. Nairobi, Mombasa, Kiambu, and Nakuru continue to absorb most of the national housing supply pipeline. Public infrastructure spending under transport, water, and energy sectors continues to influence price behavior in new development zones.

Institutional investors, diaspora buyers, and regional private capital increased participation in income generating residential assets during 2024. This report consolidates market data, transaction benchmarks, and sector performance indicators used by developers, lenders, analysts, and media contributors covering real estate in Kenya.

Data and Market Insights

National Price Performance

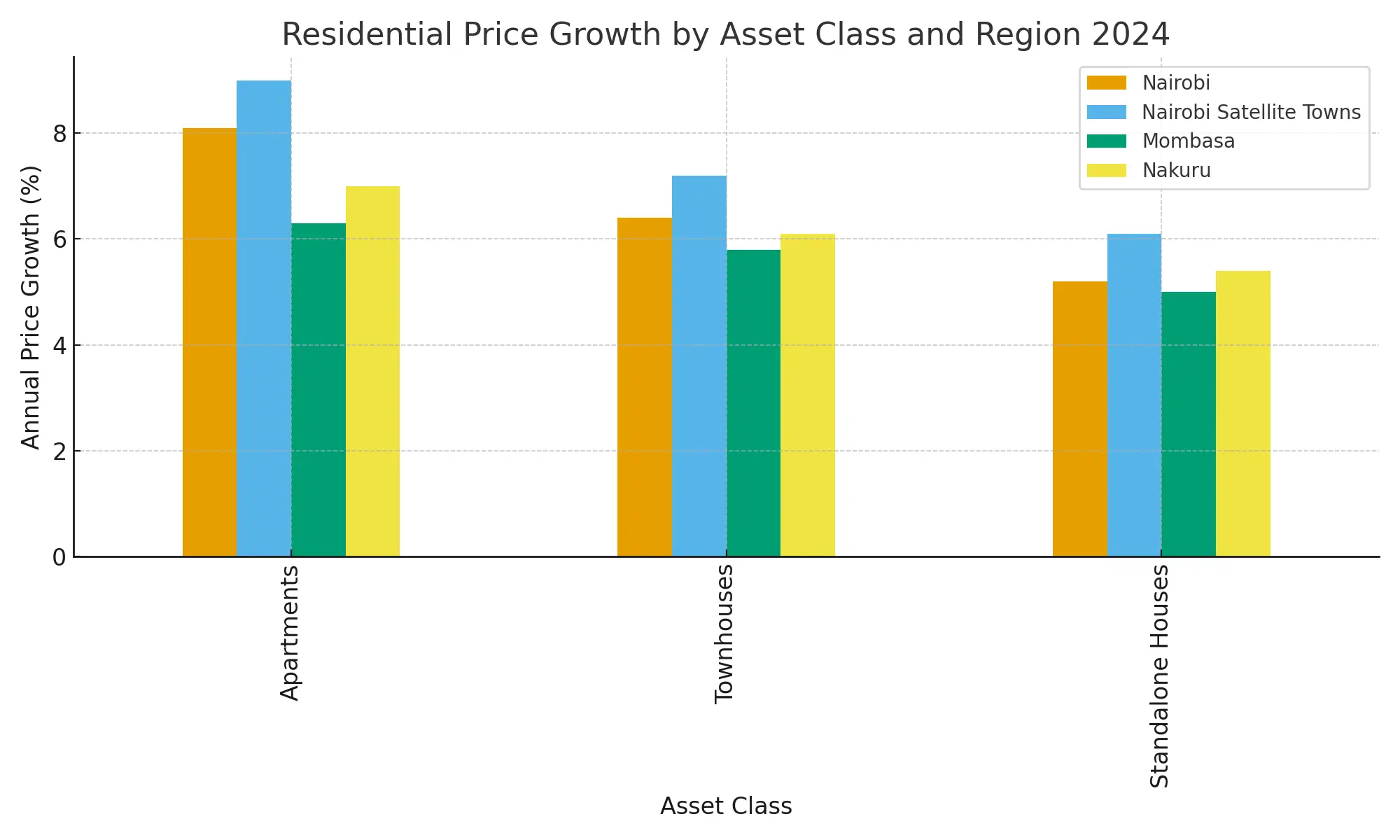

Residential prices across Kenya recorded average annual growth of 6.8 percent in 2024. Urban satellite towns accounted for above median growth. Central Nairobi recorded moderate price movement due to supply normalization in the apartment segment.

Average national residential price trends by asset type are summarized below.

|

Asset Type |

Average 2024 Price Change |

|

Apartments |

7.4 percent |

|

Townhouses |

6.1 percent |

|

Standalone houses |

5.3 percent |

|

Mixed use residential |

7.9 percent |

Price growth remained strongest in zones linked to new road infrastructure and industrial nodes. Growth in real estate in Kenya continues to align closely with transport accessibility and employment concentration.

Urban Supply Distribution

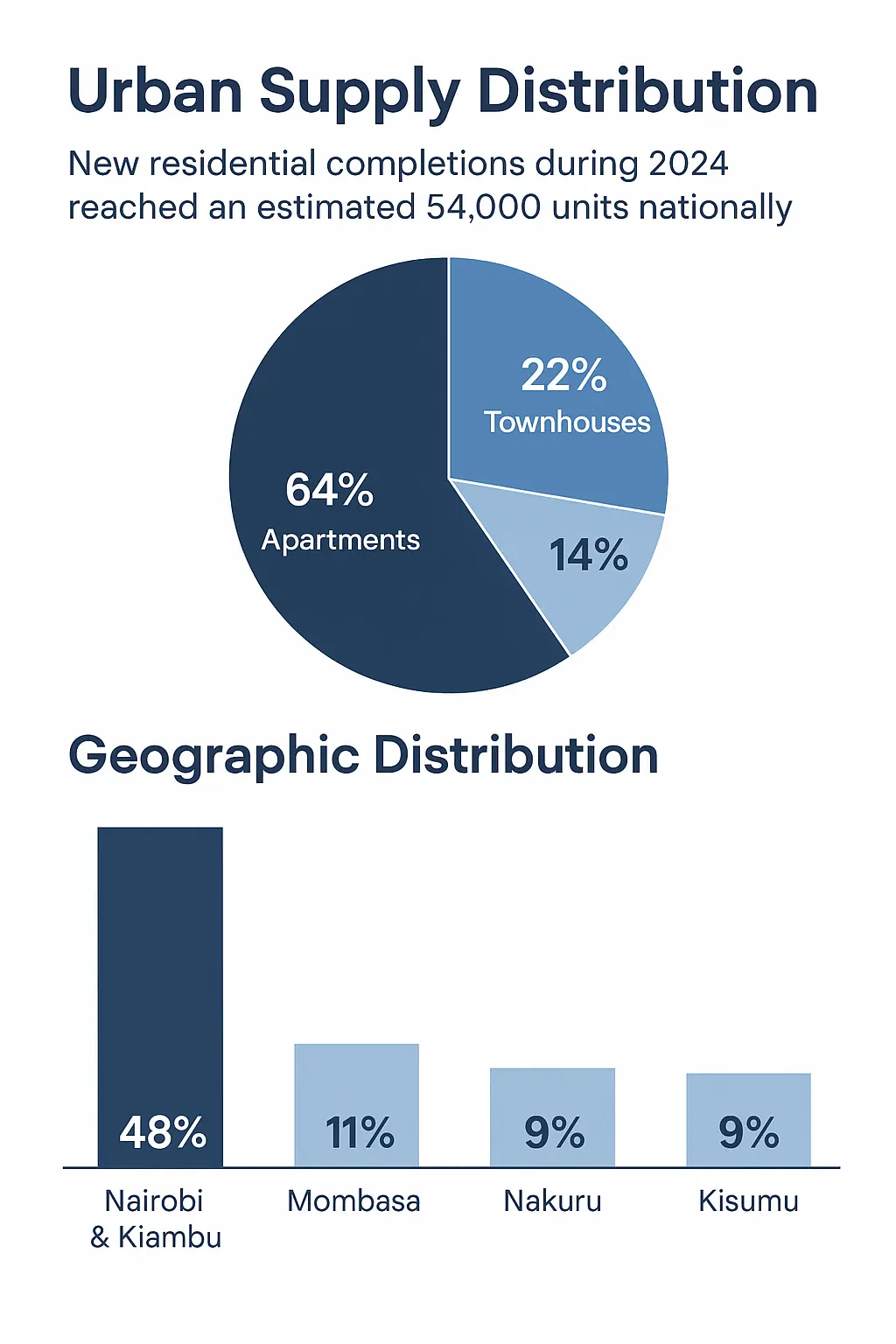

New residential completions during 2024 reached an estimated 54,000 units nationally. Apartments accounted for nearly two thirds of completed stock. Townhouses accounted for 22 percent. Standalone houses made up the remaining share.

Nairobi and Kiambu jointly accounted for more than 48 percent of new residential supply. Mombasa followed at 11 percent. Nakuru and Kisumu combined accounted for 9 percent.

This distribution reflects developer preference for high density formats in zones with established demand depth and rental absorption capacity.

Rental Market Performance

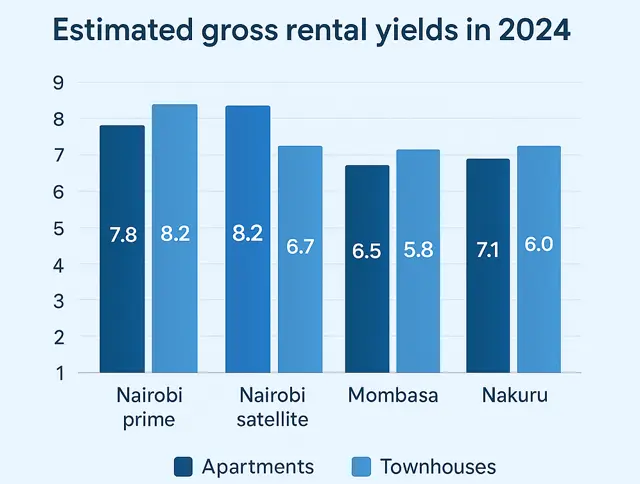

Rental yields remained stable in most prime and middle income residential zones. Apartment yields outperformed landed housing due to stronger tenant demand and shorter vacancy cycles.

Estimated gross rental yields in 2024 are summarized below.

|

Location |

Apartments |

Townhouses |

|

Nairobi prime |

7.8 percent |

6.2 percent |

|

Nairobi satellite |

8.2 percent |

6.7 percent |

|

Mombasa |

6.5 percent |

5.8 percent |

|

Nakuru |

7.1 percent |

6.0 percent |

Rental demand growth remained strongest along major commuter corridors linked to the Nairobi expressway, Thika Road, and commuter rail access.

Mortgage Market Indicators

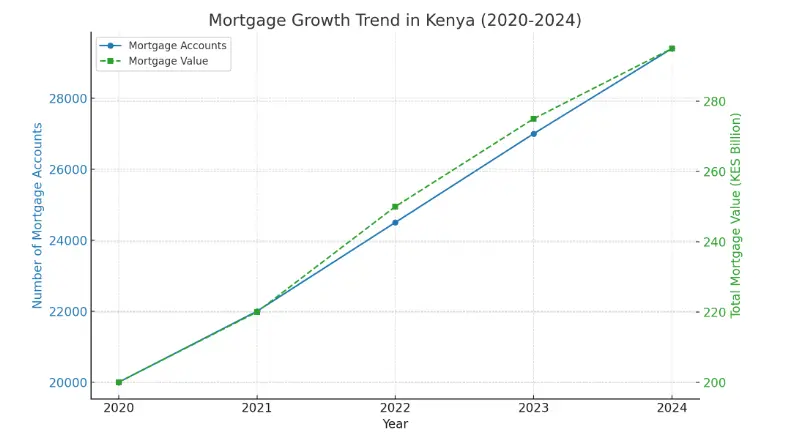

Mortgage uptake increased despite interest rate pressure from monetary tightening. Outstanding mortgage accounts rose from an estimated 27,000 to 29,400 during 2024. Total mortgage value crossed KES 295 billion by year end estimates.

Mortgage penetration in Kenya remains below 1 percent of GDP, signaling long term structural growth potential tied to income expansion and credit market reforms.

Banks continue to favor salaried borrowers within the middle and upper income brackets. Affordable segmented mortgage funding remains constrained by credit risk pricing and household income volatility.

Commercial Property Market

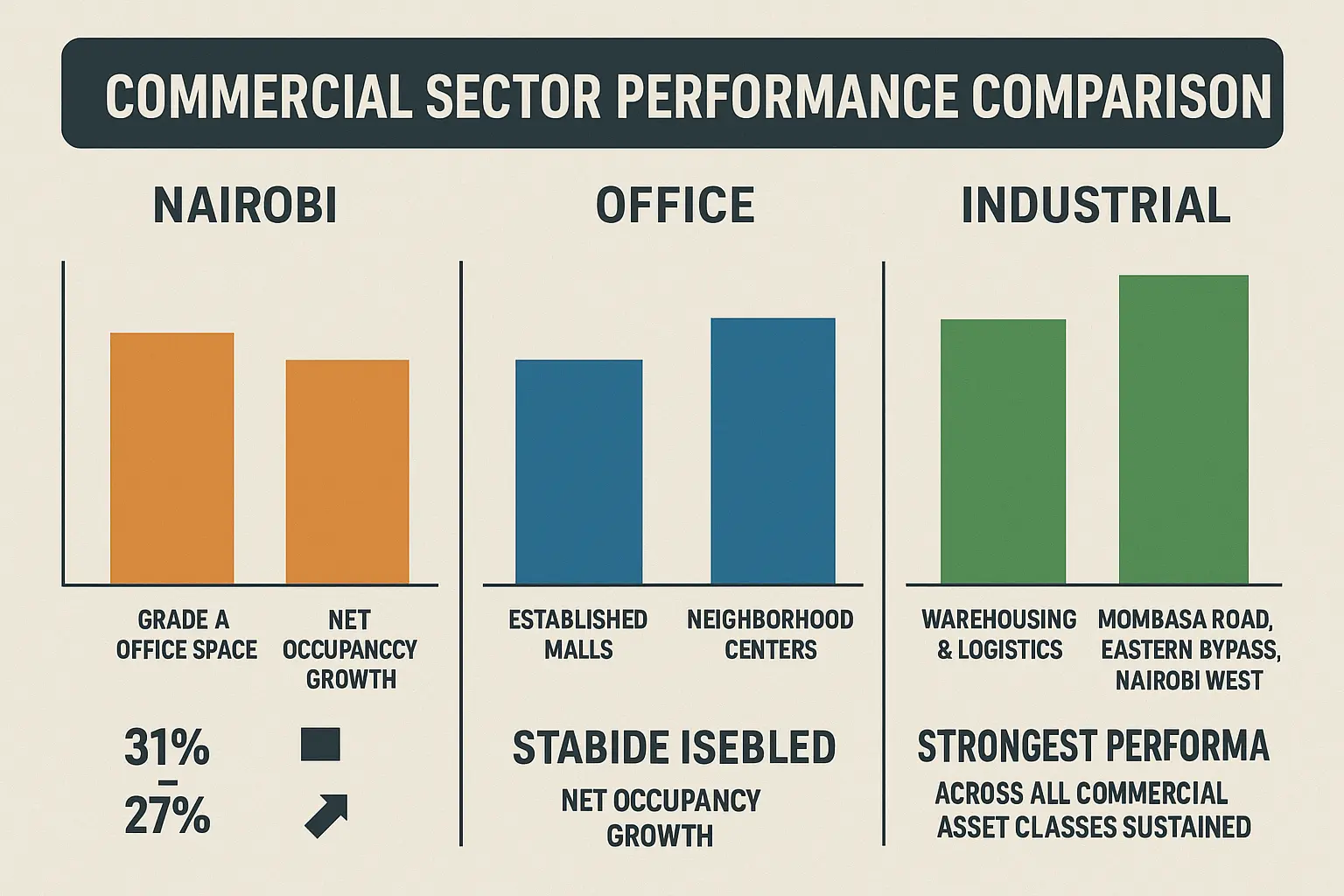

Office absorption in Nairobi recorded improvement in the second half of 2024 due to renewed hiring in finance, logistics, and technology services. Vacancy levels in Grade A office space declined from an estimated 31 percent to 27 percent.

Retail property performance stabilized in established malls linked to high density residential catchments. Neighborhood retail centers outperformed regional malls in net occupancy growth.

Industrial property recorded the strongest performance across all commercial asset classes. Warehousing and logistics facilities along Mombasa Road, Eastern Bypass, and Nairobi West recorded sustained demand from e commerce, manufacturing, and regional distribution tenants.

Land Market Activity

Land values in satellite towns recorded stronger growth than inner city zoned residential land. Kiambu peripheral zones, Athi River, Juja, and Ngong maintained active subdivision and transaction levels.

Land price appreciation averaged between 8 percent and 15 percent annually depending on proximity to new road and utility infrastructure.

Speculative land holding activity moderated during 2024 as financing costs increased. End user acquisition remained the dominant demand segment.

Diaspora and Foreign Capital Flows

Diaspora remittances to Kenya exceeded USD 4.15 billion in 2024 based on central bank estimates. Real estate accounted for an estimated 28 to 35 percent of these inflows.

Capital flows targeted residential apartments, mixed use developments, and land banking in suburban growth zones. Foreign corporate investment remained concentrated in industrial parks and logistics hubs linked to regional trade networks.

Interpretation and Market Analysis

Price data confirms that real estate in Kenya remains fundamentally demand driven by population growth and internal migration. Kenya real estate continues to experience structural supply gaps within the formal housing sector even with rising development activity. Apartment dominated supply indicates developer alignment with urban affordability bands and rental demand consistency.

Rental yield stability points to balanced short term supply and demand in core urban zones. Yield compression in prime sites reflects land cost escalation and high construction input costs. Suburban locations continue to deliver stronger cash flow returns due to lower entry price points.

Mortgage market growth signals rising home ownership interest but affordability remains constrained by borrowing costs and formal income qualification thresholds. Expansion of alternative housing finance instruments and tenant purchase models may impact home ownership rates in the medium term.

Commercial property data shows a gradual recovery phase. Industrial property demand remains structurally supported by Kenya regional trade positioning and manufacturing policy focus. Office demand recovery remains uneven across sub markets.

Land market performance reflects continued infrastructure led investment behavior. Corridor driven price movement implies that national transport planning remains one of the most influential drivers of spatial value creation in real estate Kenya.

In Nairobi, institutional demand continues to target emerging nodes such as Westlands fringe, Upper Hill extensions, and high density eastern suburbs. This aligns closely with ongoing construction of transport links, sewer upgrades, and power capacity expansion.

Regional Market Snapshot

Nairobi Metropolitan Region

The Nairobi metropolitan market remains the core growth engine for Kenya real estate. Apartment completions dominated supply. Rental yield performance remained above the national urban average. Transaction volumes showed moderate growth driven by owner occupier demand and investor stock rotation.

Anchored search demand linked to real estate in Nairobi remains the highest nationally due to transaction transparency and professional brokerage penetration.

Coastal Region

Mombasa and the South Coast recorded stable residential activity with price growth averaging 4.9 percent. Tourism linked short stay apartments supported seasonal rental performance. Industrial port linked zones reported new warehousing investments.

Rift Valley Towns

Nakuru, Eldoret, and Naivasha continued to attract logistics, education, and manufacturing driven housing demand. Land values near industrial parks recorded above average price growth.

Western Kenya Towns

Kisumu maintained modest residential growth supported by lake region trade and county level infrastructure investment. Commercial office supply remained limited.

Market Risks and Constraints

Construction input costs remained elevated during 2024 due to currency pressure and imported material pricing. Developer margin compression remains a constraint in low income housing segments.

Regulatory compliance costs across approvals, environmental licensing, and utility connections continue to affect project timelines.

Household income vulnerability remains a credit risk factor for mortgage lenders. Rental market oversupply risk exists in select high density apartment corridors.

Methodology and Data Sources

This market report consolidates data from the following sources:

- Kenya National Bureau of Statistics housing and construction sector publications

- Central Bank of Kenya mortgage and remittance data

- County government development approval statistics

- Property market surveys from registered valuation firms

- Industry transaction benchmarks from licensed brokers

- Aggregated construction permit and completion records

Data was normalized to reflect national averages and urban weighted market behavior. All values represent consolidated estimates based on public and industry validated records.

Conclusion

The 2025 market outlook indicates that real estate in Kenya remains structurally resilient despite credit tightening and input cost pressure. Demand fundamentals linked to urban growth, infrastructure spending, and diaspora capital remain intact. Kenya real estate continues its transition toward higher density residential formats supported by rental driven investment logic.

Real estate Kenya performance for 2025 is expected to reflect moderate price growth, steady rental income stability, and selective commercial sector recovery. Market participants will continue to prioritize infrastructure aligned zones and income backed residential formats.

Get in Touch